AI in Financial Services: Market Trend Use Cases

Financial institutions use AI to cut client service costs by 90% and process thousands of market signals for smarter investment decisions.

Written by

Adam Stewart

Key Points

- Process 1,000+ investment signals to predict market trends with high accuracy

- Cut client communication costs by 90% with automated AI service agents

- Reduce manual verification tasks from 30 hours to minutes using AI

- Handle petabytes of real-time data for instant trading decisions

AI is transforming financial services, driving efficiency, accuracy, and cost savings across the industry. Tools like BlackRock's Aladdin, LSEG-Microsoft AI Agents, and Dialzara showcase how AI is reshaping market analysis, operational workflows, and client interactions. Here's what you need to know:

- BlackRock's Aladdin: Predicts market trends using over 1,000 investment signals and two decades of data. It reduces costs and enhances portfolio management with automated models.

- LSEG-Microsoft AI Agents: Processes massive datasets for real-time market insights. It simplifies operations, cuts costs, and scales efficiently via Microsoft Azure.

- Dialzara: Automates client communication, reducing operational costs by up to 90%. It ensures fast, consistent responses with 24/7 availability.

Each tool serves a specific purpose, from institutional market analysis to client-facing communication. Choosing the right AI solution depends on your firm's needs, whether it's improving decision-making, cutting costs, or enhancing client service.

1. BlackRock's Aladdin

For over 15 years, BlackRock's Aladdin platform has been leveraging AI to tackle complex financial datasets [5]. It’s a system built on a wealth of data - training on 400,000 earnings call transcripts and over two decades of market data. The result? A tool that delivers highly accurate stock performance predictions [5].

Market Trend Analysis Accuracy

Aladdin processes more than 1,000 investment signals to identify critical market trends [5]. But it doesn’t stop at analyzing traditional financial data. The platform also incorporates alternative sources, such as online job postings, to provide deeper insights into market movements [5]. Additionally, its Aladdin Copilot feature uses generative AI to deliver immediate answers during high-stakes scenarios, like regulatory changes or sudden market fluctuations [6].

"As an AI first-mover, we seek to transform massive sets of financial and alternative data into consistent alpha."

– BlackRock Systematic Investing [5]

This advanced analytical approach not only enhances decision-making but also supports a more cost-efficient structure.

Cost Efficiency

Aladdin's cost-effectiveness is further amplified by its Augmented Investment Management (AIM) system, introduced in 2014. This system allows for the creation of custom alpha models at a fraction of the cost of traditional discretionary methods [7]. By automating thousands of investment signals, Aladdin reduces manual work and associated costs [7]. Its simulators also yield results that closely mirror actual portfolio performance, minimizing the financial risks tied to discrepancies between models and execution [7].

Scalability

Built on Microsoft Azure and supported by open APIs, Aladdin offers a unified view of both public and private markets [6]. This flexibility enables portfolio managers to configure custom AI models tailored to their needs, balancing capacity and adaptability across a wide range of datasets [7]. BlackRock’s global systematic investing team collaborates with the platform, ensuring its insights remain actionable and relevant [5]. The modular machine learning pipeline further enhances scalability, allowing Aladdin to deliver insights that meet the demands of diverse financial services.

"Aladdin Copilot is making Aladdin more intelligent and responsive - enhancing productivity, enabling scale, and providing ever-more insights within the Aladdin platform."

– Syril Smith Garson, Head of Product, AI at BlackRock [6]

2. LSEG-Microsoft AI Agents

In December 2025, the London Stock Exchange Group (LSEG) and Microsoft unveiled AI agents designed to process over 33 petabytes of financial data, handling billions of updates daily [12, 14]. This collaboration combines LSEG's vast data resources with Microsoft Azure's cloud infrastructure, serving a global customer base of over 44,000 across 190 countries [8].

Market Trend Analysis Accuracy

These AI agents rely on decades of historical, multi-asset data - referred to as "AI Ready Content" - to deliver precise market trend analyses [9]. By leveraging the open-source Model Context Protocol (MCP), the agents fine-tune how large language models interpret financial data. This approach minimizes errors, often called "hallucinations", and blends human expertise with LSEG's advanced analytics libraries [14, 16]. The result? High-speed scenario analysis that can respond to market shifts in mere seconds [10].

"AI agents are expected to be fundamental to increasing efficiencies with the ability to process data much faster than humans and making analysis quicker and more accurate."

– Emily Prince, Group Head of Analytics, LSEG [10]

Cost Efficiency

This advanced analytical system also brings notable cost savings. The MCP standard simplifies data integration by creating a unified environment, eliminating the need for multiple systems [14, 16]. For example, financial institutions using AI have reported a 40% reduction in costs for verifying commercial banking clients [2]. Tasks like preparing pitchbooks, which traditionally take 15 to 30 hours weekly, can now be completed in just minutes [11]. Additionally, Microsoft Copilot Studio's low-code platform enables professionals to create custom agents quickly, avoiding expensive development processes. Fully adopting AI could improve efficiency ratios by as much as 15 percentage points [2]. These streamlined operations make scalability more achievable.

Scalability

Powered by Microsoft Azure, the platform efficiently handles LSEG's massive data ecosystem, which tracks millions of financial instruments across global markets. MCP ensures secure, standardized integration, enabling scalability without a significant rise in infrastructure costs [12, 13, 14, 16]. A recent example is Microsoft's internal decision hub, "Qiro", which integrates LSEG market intelligence with Microsoft Treasury's systems. This tool allows treasury teams to manage risks and make critical decisions in real time [11]. By enhancing both speed and precision, this scalable system transforms financial operations and market trend predictions.

"LSEG customers can build, deploy and scale agentic AI directly into their workflows with secure, seamless connectivity through MCP."

– David Schwimmer, Group Chief Executive Officer, LSEG [9]

3. Dialzara

While large platforms like BlackRock's Aladdin and LSEG-Microsoft AI agents dominate institutional market analysis, financial services firms also need tools to streamline client-facing operations. It's not just about gathering insights - it's about acting on them. Dialzara steps into this space, providing an automated solution to handle client inquiries, ensuring that market insights can be turned into actionable business opportunities.

Cost Efficiency

Dialzara’s AI-powered phone answering service can reduce operational costs by up to 90%. By automating the screening of client inquiries, it slashes manual review time by 75% and operates around the clock. This 24/7 availability is a game-changer for financial advisors and wealth management firms that serve clients across different time zones or need to respond quickly to market-related questions.

The system ensures consistency by using a standardized, data-driven approach to every client interaction. Unlike human operators who may vary in judgment, Dialzara applies pre-set criteria that can adjust to market conditions, ensuring client qualification stays relevant as the economy shifts. This allows advisors to focus on what really matters - building client relationships and crafting portfolio strategies - while the system handles the administrative tasks. The result? A more efficient operation that supports scalable, client-centered growth.

Scalability

Dialzara integrates effortlessly with over 5,000 business applications, allowing firms to expand without the need for major system overhauls. Setup is quick - just a few minutes to train the AI on specific industry terms, configure voice options, and set up call forwarding. This flexibility means firms can respond instantly to spikes in client inquiries driven by market activity, ensuring they’re always ready to meet demand.

sbb-itb-ef0082b

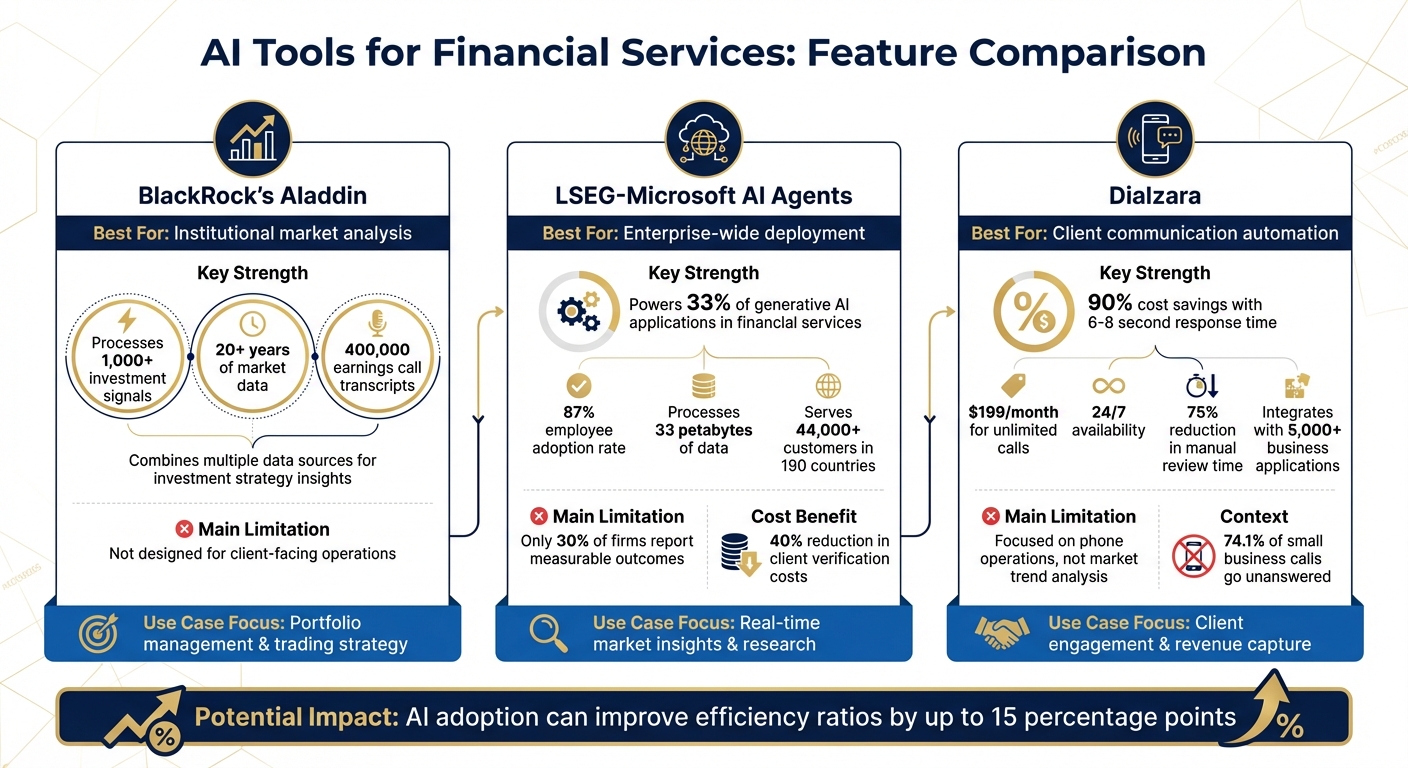

Pros and Cons

AI Tools Comparison for Financial Services: BlackRock Aladdin vs LSEG-Microsoft vs Dialzara

Here’s a breakdown of the strengths and limitations of these tools, giving financial services firms a clearer perspective on their roles in the market.

Each tool has its own standout features, but understanding their drawbacks is equally important for making well-informed decisions.

BlackRock's Aladdin is a powerhouse for institutional-level market analysis. It integrates structured and unstructured data sources to provide long-term investment projections [12]. However, its focus is primarily on portfolio management and trading strategy, leaving client-facing operations outside its scope.

LSEG-Microsoft AI Agents tap into the robust Microsoft and OpenAI ecosystem, which currently powers 33% of generative AI applications in financial services [1]. This enterprise-wide framework allows for rapid scalability, with early adopters like Klarna achieving 87% employee adoption within just a year [1]. The challenge? Only 30% of firms report measurable outcomes, making it tough to assess ROI [1]. As CB Insights warns:

"Financial services firms without a plan to provide genAI access to employees risk competitive disadvantage" [1].

On the other hand, Dialzara focuses on client engagement, helping businesses capture revenue opportunities by optimizing communication. It offers rapid response times and significant cost savings. At $199 per month, it supports unlimited calls and responds within 6–8 seconds, compared to the 30–90 seconds required by human operators [4]. This is especially relevant given that 74.1% of incoming calls to small service businesses go unanswered, leading to substantial revenue loss [13].

| Tool | Best For | Key Strength | Main Limitation |

|---|---|---|---|

| BlackRock's Aladdin | Institutional market analysis | Combines multiple data sources for investment strategy insights [12] | Not designed for client-facing operations |

| LSEG-Microsoft AI Agents | Enterprise-wide deployment | Powers 33% of generative AI applications; scales across the workforce (87% employee usage) [1] | Only 30% of firms disclose measurable impact data |

| Dialzara | Client communication | Achieves 90% cost savings with a 6–8 second response time at $199/month [4] [13] | Focused on phone operations, not market trend analysis |

This comparison underscores how each tool addresses distinct operational needs in the financial sector.

For firms focusing on data-driven forecasting, tools like Aladdin and LSEG-Microsoft AI Agents are invaluable. Meanwhile, Dialzara ensures businesses don’t lose out on revenue due to missed calls - a critical advantage, especially for capturing after-hours leads [4].

Conclusion

As highlighted earlier, each AI tool serves a distinct purpose - whether it's conducting detailed market analysis or streamlining client communication - creating a well-rounded approach to financial services.

The key is selecting the AI solution that aligns with your firm's specific requirements. For instance, BlackRock's Aladdin excels in institutional risk monitoring and portfolio decision-making, offering unmatched insights for large-scale financial operations [3].

Meanwhile, LSEG-Microsoft AI Agents stand out for their ability to autonomously process market data and provide real-time advisory insights, making them invaluable for research-heavy tasks and wealth management [2][1]. Studies suggest that fully embracing AI can improve efficiency ratios by as much as 15 percentage points [2].

Integrating these tools strengthens internal operations while enhancing client interactions. Dialzara, for example, revolutionizes client communication by automating 24/7 call handling, ensuring quick responses and reducing costs, as discussed earlier.

A strategic combination of these tools can significantly elevate overall performance. Use predictive AI like Aladdin for risk analysis, rely on agentic AI for advisory workflows, and implement Dialzara to handle client-facing communication seamlessly. As PwC aptly states:

"The efficiency ratio is no longer a backward-looking performance metric. It's becoming the most telling forward-looking indicator of your bank's ability to leverage AI innovation to compete, grow and endure." [2]

FAQs

How does AI help financial services save money and operate more efficiently?

AI helps financial services save money by taking over repetitive tasks like data entry and transaction processing. This reduces the reliance on manual labor and speeds up operations. At the same time, AI can process and analyze data much faster, allowing for quicker decision-making without driving up operational costs.

By simplifying workflows and reducing mistakes, AI not only saves time but also trims expenses tied to labor and inefficiencies. This means financial institutions can manage more work, maintain high standards, and stay budget-friendly.

How do BlackRock's Aladdin platform and LSEG-Microsoft AI Agents differ?

Unfortunately, the available sources don't provide enough details to compare BlackRock's Aladdin platform with the LSEG-Microsoft AI Agents. Without more information about their specific features or capabilities, it's difficult to draw any meaningful distinctions.

If you can share additional details or sources about these solutions, we'd be glad to help break down their differences.

How does Dialzara improve client communication for financial services firms?

Dialzara equips financial services firms with a round-the-clock AI virtual assistant designed to handle calls using natural, lifelike voice technology. It doesn’t just answer calls - it captures client details, directs inquiries to the right expert, and manages tasks like scheduling appointments or verifying accounts. And it does all of this in real time, ensuring no call slips through the cracks and improving resolution rates on the first try.

What makes Dialzara even more powerful is its ability to integrate with over 5,000 business tools, including CRMs and loan origination systems. This means it can instantly pull up client histories, qualify leads, and update records automatically. The result? Faster onboarding, smoother follow-ups, and lower operational costs.

Professionals like financial advisors, wealth managers, and insurance agents benefit greatly from Dialzara’s 24/7 availability and ability to deliver precise, context-aware information - even outside of regular business hours. With its scalable system, firms can handle larger call volumes while cutting receptionist costs by up to 90%, all without sacrificing quality.

Summarize with AI

Related Posts

5 AI Customer Service Success Stories in Banking

Discover 5 success stories of AI customer service in banking, showcasing benefits like automation, personalization, efficiency, accuracy, and competitive edge.

AI in Financial Planning: Benefits for SMBs

Explore how AI tools transform financial planning for SMBs, enhancing efficiency, reducing costs, and providing real-time insights for smarter decisions.

How AI Ensures 24/7 Customer Service Availability

Explore how AI enhances customer service with 24/7 availability, improved experiences, and seamless integration into business operations.

AI-Powered Customer Service: Cost Breakdown

Explore how AI-powered customer service reduces costs, enhances efficiency, and transforms customer interactions with 24/7 support and personalized experiences.